ETH Price Prediction: Path to $5,000 Amid Strong Technical and Fundamental Tailwinds

#ETH

- ETH trading above 20-day MA with improving MACD momentum suggests technical strength

- Record institutional adoption and whale accumulation exceeding 450,000 ETH provide fundamental support

- Bollinger Band resistance near $4,960 and psychological $5,000 level represent key targets

ETH Price Prediction

Technical Analysis: ETH Approaches Key Resistance Levels

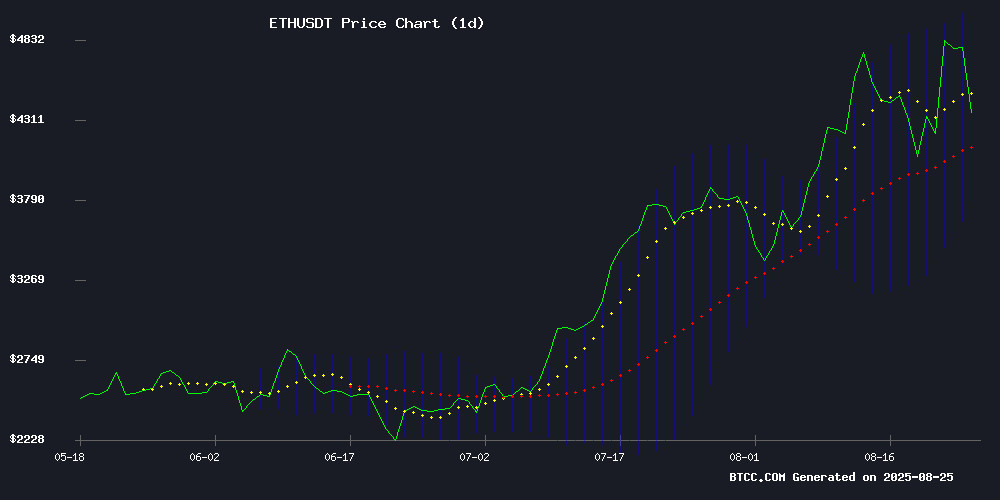

ETH is currently trading at $4,416.30, hovering above its 20-day moving average of $4,365.72, indicating underlying bullish momentum. The MACD shows improving conditions with a histogram reading of 39.51, though both lines remain in negative territory. Bollinger Bands suggest potential resistance NEAR $4,959.79, with support around $3,771.65. According to BTCC financial analyst Robert, 'The technical setup suggests ETH is testing crucial resistance levels. A sustained break above $4,500 could pave the way toward the $5,000 psychological barrier.'

Market Sentiment: Institutional Momentum Builds for ETH

Positive news FLOW surrounds Ethereum, with several catalysts driving bullish sentiment. Ethereum's market cap surpassing $500 billion faster than any asset in history demonstrates unprecedented institutional adoption. Significant whale accumulation of over 450,000 ETH and corporate treasury expansions like ETHZilla's $489 million Ether holdings create substantial buying pressure. BTCC financial analyst Robert notes, 'The combination of institutional adoption, whale accumulation, and fundamental developments like Buterin's FOCIL framework creates a constructive backdrop for Ethereum's price appreciation toward $5,000.'

Factors Influencing ETH's Price

Buterin Highlights Yield Gap in Prediction Markets Amid Growing Debate

Ethereum co-founder Vitalik Buterin has injected fresh perspective into the intensifying discourse around prediction markets, identifying a critical yield disadvantage that limits their appeal to risk-averse participants. The absence of interest-bearing mechanisms forces traders to forfeit guaranteed returns—like the 4% annual yield on dollars—simply to engage, Buterin argued in a Farcaster post.

The commentary arrives as platforms like Polymarket face scrutiny from traditional finance voices. Former quant trader Agustin Lebron branded prediction markets as structurally unstable, warning they could trigger reflexive feedback loops between wagers and real-world events. His critique centers on the lack of institutional hedgers—a cornerstone of conventional markets—which leaves these platforms dominated by speculative traders and retail gamblers.

Pseudonymous market participant @TomJrSr countered with a bullish defense, though the truncated response leaves the debate unresolved. Buterin's proposed solution—innovative yield mechanisms—could unlock hedging utilities and drive mainstream adoption, potentially creating new synergies with DeFi ecosystems.

Ethereum Surpasses $500B Market Cap Faster Than Any Asset in History

Ethereum has achieved a historic milestone, becoming the fastest asset ever to reach a $500 billion market capitalization. The cryptocurrency's valuation surged past the half-trillion mark amid a sharp price rally, outpacing even Bitcoin and major corporations during their growth cycles.

The second-largest crypto by market cap hit an all-time high of $4,946 last week, fueled by heavy trading activity and accumulation. This peak propelled ETH's market capitalization beyond the $500 billion threshold at an unprecedented pace.

Long-term Ethereum investors are now sitting on unrealized gains exceeding twice their initial investments, according to Glassnode's Market Value to Realized Value (MVRV) ratio. The metric, which compares market cap to aggregate acquisition costs, currently stands at 2.15 - a level last seen during periods of heightened volatility in late 2020 and early 2024.

ETHZilla Authorizes $250M Buyback, Expands Ether Treasury to $489M

ETHZilla (ETHZ) has greenlit a $250 million stock repurchase initiative, intensifying its ether-centric treasury approach. The Florida-based firm's board approved the buyback effective immediately, with the program running through June 30, 2026.

The Nasdaq-listed company now holds 102,237 ETH acquired at an average price of $3,948.72—worth approximately $489 million at current valuations. Its war chest includes $215 million in cash equivalents. "Aggressive repurchases at current prices demonstrate our commitment to shareholder value," said Executive Chairman McAndrew Rudisill.

ETHZilla simultaneously unveiled its proprietary Electric Asset Protocol designed to amplify yields on crypto holdings. The move reinforces its dual strategy of accumulating ether reserves while deploying novel yield-generation mechanisms.

ETHZilla Announces $250M Stock Buyback Amid Ethereum's Market Surge

ETHZilla Corporation, a Nasdaq-listed Ethereum treasury firm, has authorized a $250 million stock repurchase program following a 53% weekly plunge in its share price. The move comes as Ethereum itself reaches new all-time highs, contrasting sharply with ETHZilla's market performance.

The company's stock decline accelerated after an SEC filing revealed plans to issue 74.8 million convertible shares, potentially diluting existing shareholders. ETHZilla shares had previously tripled in value after Peter Thiel's investment, but now trade at $3.18—erasing most recent gains.

Market observers note the irony of a Ethereum-focused firm struggling despite ETH's bullish momentum. The buyback signals management's attempt to stabilize the stock while navigating the volatile crypto equity landscape.

Top 3 Cryptos Benefiting On the Way to $5 Trillion This Year – Institutional Adoption Favorites

Massive institutional inflows are reshaping the cryptocurrency landscape as blue-chip investors pivot toward digital assets. Ethereum emerges as a clear frontrunner, trading between $4,245 and $5,136 with key resistance levels in sight. The asset maintains an 88% six-month gain despite recent bearish pressure, suggesting enduring institutional confidence.

Technical indicators reveal a nuanced picture: RSI at 40 and MACD below zero signal short-term caution, while the defense of $3,710 support demonstrates underlying strength. A decisive break above $5,136 could trigger a 15% rally toward $5,492, with potential for 50% upside if historical resistance at $6,500 is challenged.

The broader market movement reflects growing institutional participation, with select cryptocurrencies attracting disproportionate attention from sophisticated investors. Market structure suggests accumulating positions are being established during periods of price consolidation.

Ethereum Whale Buying Spree Tops 450K ETH, Pushing Price Toward $5,000

Ethereum whales have aggressively accumulated over 450,000 ETH within 48 hours, signaling strong institutional confidence in the asset's upside potential. The surge in smart money activity coincides with ETH testing the $4,900 resistance level, with analysts predicting a breakout toward $5,000 could trigger cascading short squeezes.

Despite a 3.75% intraday pullback to $4,599, derivatives markets remain balanced with neutral funding rates—suggesting room for sustained momentum. Trading volumes exceeded $69 billion as the Ethereum ecosystem continues attracting capital inflows ahead of anticipated protocol upgrades.

Presale Wars: Pepeto and BlockDAG Compete for Investor Attention

Two contrasting presale strategies are emerging in 2025’s crypto market. Pepeto, an Ethereum-based project, has raised $6.3 million by emphasizing Web3 utility and NFT integrations. Its roadmap promises community-driven tools, though specifics on deliverables remain unclear. The team hints at an upcoming exchange listing, but momentum relies heavily on narrative rather than tangible milestones.

BlockDAG takes a more aggressive approach, engineering demand through gamification. With $383 million raised and 25.3 billion BDAG coins sold, its "Buyer Battles" system turns presales into daily engagement. The project’s Batch 29 pricing ($0.0276) reflects relentless staging, contrasting sharply with Pepeto’s wait-and-see hype cycle. Here, traction isn’t hoped for—it’s algorithmically enforced.

BitMine's Ethereum Holdings Approach $8 Billion Amid Record ETH Prices

BitMine Immersion Technologies has aggressively expanded its Ethereum treasury, adding $2.2 billion in ETH and cash holdings last week alone. The firm now controls 1.71 million ETH—nearly 1.5% of the total supply—valued at $8 billion as the cryptocurrency reaches all-time highs.

Chairman Tom Lee framed the accumulation as part of BitMine's 'alchemy of 5%' strategy, noting institutional investors are fueling one of the fastest-growing crypto treasuries. The company's shares (BMNR) have surged 36% monthly, outpacing competitors as it trails only MicroStrategy in publicly traded crypto holdings.

Last week's addition of 190,500 ETH follows an even larger $1.7 billion purchase of 373,000 ETH, demonstrating accelerating institutional adoption. 'We're leading peers in both crypto NAV growth and stock liquidity,' Lee declared, underscoring the firm's pivot from Bitcoin mining to Ethereum-focused treasury building.

Ethereum Price Pullback Holds Amid Strong Social Buzz, $6000 Target in Sight

Ethereum's price retreated 1.7% to $4,770, yet maintained a robust 10% weekly gain. The asset briefly touched $4,946 before cooling off, preserving a 7% monthly advance.

Social media activity surged, with Ethereum commanding 13.5% of all crypto discussions according to LunarCrush data. Such dominance typically precedes heightened trading activity and potential price volatility.

Market structure appears constructive—exchange outflows, positive CMF, and $2.44 billion in short positions above $5,400 suggest traders are positioning for a potential breakout. The $4,950 resistance level remains key; a decisive breach could open a path toward $6,000.

Vitalik Buterin Proposes FOCIL Framework to Combat Ethereum Censorship

Ethereum co-founder Vitalik Buterin has introduced the Fork-Choice Enforced Inclusion (FOCIL) framework as a solution to mitigate transaction censorship risks on the network. The proposal comes amid concerns over validators and MEV-boost relays selectively excluding transactions, particularly those from OFAC-sanctioned addresses.

At its peak, over 56% of Ethereum blocks complied with OFAC requirements, raising questions about blockchain neutrality. Buterin's August 2025 proposal emphasizes Ethereum's role as a neutral Layer-1 protocol that should process all valid transactions indiscriminately.

The FOCIL framework represents a technical safeguard to preserve Ethereum's "dumb pipe" functionality. It follows ongoing debates about legal pressures facing U.S.-based validators and the network's resistance to centralized influence.

Web3 Fantasy Soccer Game Football Dot Fun Sees Explosive Growth on Base

Football Dot Fun, a Web3 fantasy soccer game built on Coinbase's Base blockchain, has surged in popularity with $25.7 million in trading volume and over 10,000 unique users within two weeks of launch. The game allows players to trade fractionalized shares of real football players using in-game Gold currency, with player shares depleting as they participate in matches.

The ecosystem's market capitalization skyrocketed from $60 million to $160 million over a single weekend, with some traders reporting 3-4x portfolio gains in 24 hours. This growth echoes the 2021 NFT boom period, drawing comparisons to NBA Top Shot's early viral success.

Will ETH Price Hit 5000?

Based on current technical indicators and market developments, ETH has a strong probability of reaching $5,000 in the near term. The price is currently trading above key moving averages, showing bullish momentum, while institutional adoption and whale accumulation provide fundamental support. Key factors to monitor include:

| Indicator | Current Value | Target Level |

|---|---|---|

| Current Price | $4,416.30 | $5,000 |

| Bollinger Upper Band | $4,959.79 | Initial Resistance |

| 20-Day MA | $4,365.72 | Support Level |

As BTCC financial analyst Robert emphasizes, 'The convergence of technical breakout potential and strong fundamental catalysts positions ETH favorably for a run toward $5,000, though traders should watch for sustained volume above $4,500.'